News: SeaWorld Entertainment reportedly making bid for Cedar Fair

CED23 said:

Case in point, March 2020...

Huh, I wonder if there was anything going on around that time that would have had entertainment markets acting irrationally...

Brandon

Wouldn't it be awesome If Universal made a bid at Cedar Fair? CP rundown reported that Six flags was thinking about making another bid, but I hope and pray that doesn't happen. I can't imagine Kings Island being owned by Six flags. Plus I love the Cedar Fair Park the way it is. Also I want the Peanuts characters to stick around.

djDaemon said:

CED23 said:

Case in point, March 2020...

Huh, I wonder if there was anything going on around that time that would have had entertainment markets acting irrationally...

I picked that date specifically to show the erroneous nature of market cap, which the other poster doesn't realize.

XS NightClub said:

Zoug68 said:

As far as food goes, CF is kicking ass. The quality is really good and the service, especially at CP and KI has been fantastic and the food has been really good.

This is something I have not heard before. The only benefit I would like of SEAS taking over CF would be to the Food Services, CP is routinely awful in food prep, holding, presentation and overall service. But to each their own I guess.

This guy is always saying something he has no idea about. Guess people need to tell him to make it true. Or, you could actually visit the park and you would know for yourself.

Theme parks sell for 9 to 12X EBIDTA, normalize to 2019 EBIDTA of 505M that gives you 4.55B low end to 6.06B high end.

How are you factoring in debt in your valuation determination?

And if you like book value over market cap for determining valuation, book value of Cedar Fair's assets as of 9/26/2021 (ignoring liabilities) was $2.8 billion.

1)If you want to try to factor in debt to your valuation process you look at Enterprise Values which is the sum of its market capitalization, value of debt, minority interest, preferred shares subtracted from its cash and cash equivalents. CF's EV is 5.75B. In general in theme park industry valuations in actual transactions are EBIDTA multiples...ie...the last really big acquisitions was at a 11.5 EBIDTA of Merlin

2)No company sells for their pure asset value, unless they are about to go bankrupt & be liquidated to pay debts

There is no "wanting" to factor in debt. You must factor in debt. If there are 2 companies with the same EBITDA but one has debt and the other is debt free, the shareholders of the company with debt will not receive the same amount of cash proceeds from a sale.

From what I have seen, the SeaWorld offer assumes an enterprise value of $5.8 billion.

SeaWorld’s current bid reportedly offers Cedar Fair $60 per share, or an enterprise value of around $5.8 billion.

You were the one who suggested book value as a better approximation of value than market cap.

Do you view Cedar Fair or SeaWorld as meme stocks? Also something you brought up in the conversation.

GoBucks89 said:

There is no "wanting" to factor in debt. You must factor in debt. If there are 2 companies with the same EBITDA but one has debt and the other is debt free, the shareholders of the company with debt will not receive the same amount of cash proceeds from a sale.

From what I have seen, the SeaWorld offer assumes an enterprise value of $5.8 billion.

SeaWorld’s current bid reportedly offers Cedar Fair $60 per share, or an enterprise value of around $5.8 billion.

You were the one who suggested book value as a better approximation of value than market cap.

Do you view Cedar Fair or SeaWorld as meme stocks? Also something you brought up in the conversation.

Book value was only mentioned in the general vernacular of valuating anything. It's really only used in practice on financial stocks, banks, etc.

Like I said for the 4 the time Theme Parks are valued & acquired based on EBIDTA multiples. The theme park industry touts EBIDTA as their preferred metric, that's why you hear about it so much in their reports. The industry is a high debt industry. thus they pay quite a bit of interest, thus they like the EBIDTA metric

2)What the shareholder receives in a sale is unaffected by the debt. The buyer takes on the debt unless the seller is foolish, they don't back the debt out

3) Try re-reading to understand the meme stock reference in regards to the erroneous nature of market cap for valuing companies. The notion I said or believe SEAS & CF meme stocks is a foolish conclusion to try to draw.

4) SEAS offer is wholly not serious & has no chance.

Book value was only mentioned in the general vernacular of valuating anything. It's really only used in practice on financial stocks, banks, etc.

I thought we were talking about a specific acquisition proposal. Not general vernacular of valuations. Particularly not financial stocks or banks.

Like I said for the 4 the time Theme Parks are valued & acquired based on EBIDTA multiples. The theme park industry touts EBIDTA as their preferred metric, that's why you hear about it so much in their reports. The industry is a high debt industry. thus they pay quite a bit of interest, thus they like the EBIDTA metric

Do you think theme parks are unique in terms of valuations based on multiples of EBITDA? Common throughout the M&A world in many industries.

What the shareholder receives in a sale is unaffected by the debt. The buyer takes on the debt unless the seller is foolish, they don't back the debt out

This really doesn't make sense. Of couse the debt matters. Unless outstanding debt is being repaid in connection with an acquisition, would you pay the same for a company in the same industry and with the same EBITDA but that had substantial debt? In an acquisition debt impacts the amount received by sellers. It just does.

Try re-reading to understand the meme stock reference in regards to the erroneous nature of market cap for valuing companies. The notion I said or believe SEAS & CF meme stocks is a foolish conclusion to try to draw.

Re-reading your meme stock reference won't help because your reference doesn't make any sense in the context of the specific proposed acquisition being discussed. Would be different if we were talking about acquisition of meme entities or valuations in general. But we aren't. Exceptions that don't apply to something specific being discussed aren't relevant.

SEAS offer is wholly not serious & has no chance.

Not sure what the response will be from CF's board. Doesn't make it wholly not serious or with no chance though. Here is a Wall Street analyst who views the offered price (though indicating it seems a bit low) as being within your 9-12x EBITDA multiple:

Steven Wieczynski at Stifel says the deal makes sense, even if the offer may seem to be a bit low. Offering $60 a share in cash values Cedar Fair for what Wieczynski sees as just a little more than 10 times his estimate for the target's adjusted EBITDA multiple for the year ahead.

https://www.fool.com/investing/2022/02/07/what-does-wall-street-thi...ds-34-bil/

1)Again never said EBIDTA is just in theme park industry, but they prefer more than any other industry when discussing their performance, for the reasons stated & because they have large fixed assets subject to depreciation & amortization. Companies & industries with massive net income, free cash flow , don't talk about EBIDTA. In fact, many old school people(Warren Buffet) think it's essentially a BS metric for companies.

2)What the shareholders get is not affected by debt, when the valuation is based on EBIDTA for theme parks, it strips out the debt by basing the performance on a metric that eliminated the cost of debt, which is the interest. If you use enterprise value it includes the debt but just makes the EV higher.

3)You're reading & comprehension is clearly poor, the Meme stock example was to show the erroneous nature of valuations based on pure market cap. Which part of that is baffling you?

4)Cedar Fair's Adjusted EBIDTA in 2019 was 505M, future has it at 600M by 2024. The offer SEAS is literally you're about to go bankrupt, default on creditors, trying to steal the company. It's wholly not serious, just like SF in 2019. Cedar Fair are not fools, they know what they have & the upcoming growth levers about to come online, their tax advantage considerations, They also need 67% approval as a MLP They won't even be enticed till the offer is near 5B, which is just under $90/share.

This whole thing is like Blockbuster trying to buy Amazon. Sea world and six flags flags should be laughed out the door immediately.

First ride; Magnum 1994

But is Sandusky still dying?

Jeff - Advocate of Great Great Tunnels™ - Co-Publisher - PointBuzz - CoasterBuzz - Blog - Music

Taking a quick objective (and by objective I mean someone who doesn't have a PB account) read about it here it sure seems like it's no where near "impossible".

SEAS would not have expected Cedar Fair to agree to the initial offer, knowing full well it's too low.

All three analysts mentioned above (if you don't feel like a 3-minute read) agree that 1) the initial offer is too low, but 2) that it makes sense if CF and SEAS can negotiate up to a better offer and work out the details. They specifically mention the $100 million CF/Sandusky deal.

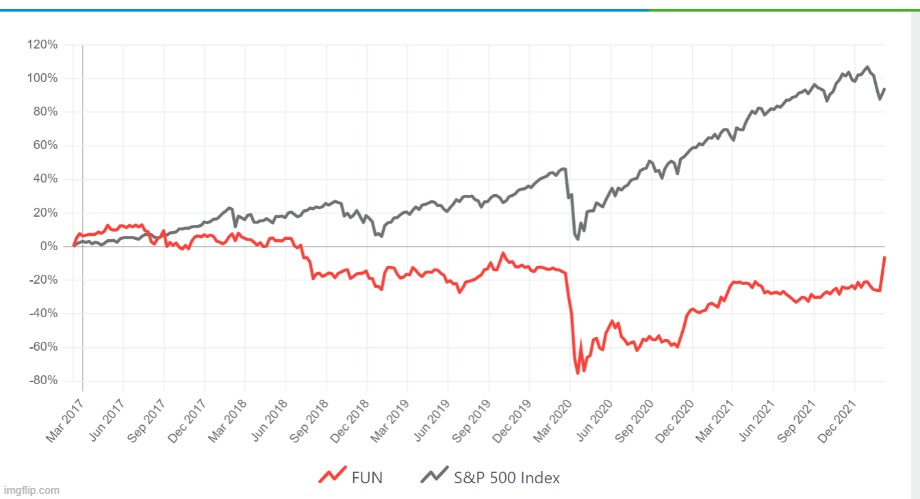

If you look at the stocks, tell me which corporation looks healthier.

or

I'm not saying it's likely, but almost everything I have read outside of rolly-coaster forums seems to suggest that it's feasible if the right price can be negotiated.

Promoter of fog.

Your delusions are noted on all accounts.

Given that you liked a post that wasn't a compliment, I am not surprised you don't get sarcasm either.

And you apparently don't understand the meaning of delusion. What is the enterprise value for the SeaWorld offer? I can give you a hint: its not $3.4 billion.

Kevinj -- Cedar Fair stock was last above $60 in July 2018 (unless it hits that today). At time $60 offer was about a 21% premium over prior day's close. Since the offer was made public, the price has increased to just under $60. Gives some indication the market thinks at least a good possibility. Back with Apollo, the offer was about 25% premium and the stock price quickly moved to that amount and continued upwards past it. If that happens here then the SeaWorld offer is effectively dead without an increase in the offer.

None of that is to say that the deal will necessarily happen. CF board may reject it out of hand. They may view themselves as not being up for sale (those as a public company there is some irony there). Or they may counter. We shall see. But I don't think its true as many here do that the offer isn't serious or is laughable. Or that Cedar Fair should be buying out SeaWorld (anyone remember Secret of My Success?).

As discussed on CB, I think the bigger issue is debt. SeaWorld does not have enough cash to pay the purchase price. So they would need to borrow money. No details of the structure of the deal have been disclosed, but there may be a change of control put under the Cedar Fair notes and a change of control default under the Cedar Fair credit agreement. That would mean additional debt (unless they can get those lender to consent/waive). And increasing the cash offer would just increase the debt required. They could change the deal to one that includes both cash and equity in SW to CF unitholders. May allow them to reduce the cash required to help reduce the debt.

But we shall see.

You do realize that in 2017 SEAS was trading at a stock price based on the fact they were about to go bankrupt. thus, by just not going bankrupt they rose by a higher %. When your stock is trading at under $10, the law of small numbers .

Now if you actually looked at Revenue, EBIDTA, Net Income Cedar Fair is "the healthier" company & always has been. The data for decades shows that & does now.

Once CF opened parks in Q3 2021, they outperformed SEAS. They did that even with 500+ rooms unavailable b/c of renovation, Wonderland under Covid limitations, & small parks closed 2 days/week.

Q3 Comparison:

SEAS: Revenue 521M, EBIDTA 263M(record). Net Income 101M(2nd highest ever)

CF: Revenue 753M(record). EBIDTA 333M, Net Income 148M

Cedar Fair running limited in many aspects as described, outperforms SEAS running essentially fully open & at or near records.

What SEAS touts as records is what Cedar Fair surpassed for the last decade without linking an eye & are equivalent to CF post 2008 financial crash metrics. The healthier company has been & is now Cedar Fair.

Given that you liked a post that wasn't a compliment, I am not surprised you don't get sarcasm either.

I got your lame joke & up voted b/c that's the response of a person that has nothing left to offer.

What is the enterprise value for the SeaWorld offer? I can give you a hint: its not $3.4 billion.

You should stop embarrassing yourself with your posts. When did I say the offer had an EV of 3.4B. You literally looked up some terms & think you know finance, you don't actually understand their meaning, relation, etc... That's proven with each post

Since the offer was made public, the price has increased to just under $60. Gives some indication the market thinks at least a good possibility.

No, actually doesn't mean that it has a good possibility. Are you a complete novice to finance & markets?

Back with Apollo, the offer was about 25% premium and the stock price quickly moved to that amount and continued upwards past it. If that happens here then the SeaWorld offer is effectively dead without an increase in the offer.

The SEAS offer of $60 was dead from the start. It's wholly not serious. Went over that several times.

But I don't think its true as many here do that the offer isn't serious or is laughable. Or that Cedar Fair should be buying out SeaWorld (anyone remember Secret of My Success?).

The offer is laughable & if CF wanted SEAS they could have gotten it cheap in 2017, when SEAS was seriously considering an offer for 1.6B

You must be logged in to post